Understanding How to Get Gynecomastia Surgery Covered by Insurance?

General Themes in Insurance Criteria

While criteria vary by insurer, several general themes recur across policies when determining coverage:

Medical Necessity for Gynecomastia Treatment

Gynecomastia must be stable for a specified duration (often at least 12 months) to rule out transient breast enlargement due to puberty or weight fluctuation.

Exclusion of Underlying Causes

Endocrinopathies, medication side effects, substance use (anabolic steroids, marijuana), and systemic diseases must be evaluated and treated or ruled out prior to surgery to strengthen the case for medical necessity.

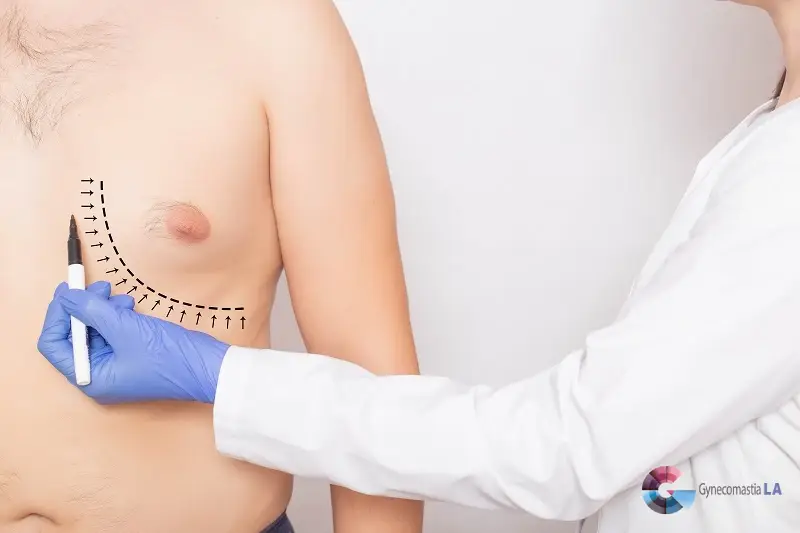

Photographic Evidence: Key to Insurance Approval for Gynecomastia Surgery

Psychological and Emotional Distress

In some policies, significant psychological distress can be considered as part of medical necessity if properly documented by mental health or medical professionals.

Specific Criteria by Major Insurance Carriers

Below is a summarized overview of common coverage criteria from several major insurance carriers. Each plan may have slight variations, so it is critical to review the patient’s specific policy details:

1. Cigna

Medical Necessity Policy

Exclusions

For those navigating how to get gynecomastia surgery covered by insurance, Cigna often requires proof of functional impairment and failure of non-surgical treatments to justify medical necessity.

2. Blue Cross Blue Shield (BCBS)

Regional Variations

Typical Coverage Considerations

Medical Necessity Policy

Exclusions

For those navigating how to get gynecomastia surgery covered by insurance, Cigna often requires proof of functional impairment and failure of non-surgical treatments to justify medical necessity.

3. Aetna

Medical Necessity Requirements

Common Exclusions

For individuals wondering how to get gynecomastia surgery covered by insurance, meeting these medical necessity requirements and submitting comprehensive documentation can improve approval chances.

4. Medicare

General Guidance

5. Kaiser Permanente

Integrated Care Model

Navigating how to get gynecomastia surgery covered by insurance with Kaiser Permanente often involves a structured evaluation and proof of medical necessity through internal referrals.

6. UnitedHealthcare (UHC)

Key Coverage Points

Tips for Securing Coverage for Gynecomastia Surgery

Build a Strong Case with Detailed Medical Records

One of the most important steps in securing insurance coverage for gynecomastia surgery is maintaining thorough clinical documentation. Physicians should carefully chart each symptom, including pain, physical limitations, and psychological distress, to demonstrate the impact of gynecomastia on the patient’s well-being. Additionally, it is crucial to document all conservative management strategies attempted, such as weight loss, hormone therapy, or medication adjustments.

Keeping consistent follow-up records that show a lack of improvement or worsening symptoms further strengthens the case for medical necessity.

Provide Undeniable Diagnostic Proof of Gynecomastia

Capture the Severity of Gynecomastia with Professional-Quality Photography

Standardized photographic documentation plays a vital role in the insurance approval process. Clear, high-quality photographs should be taken from multiple angles to illustrate the severity of gynecomastia. Many insurers require specific photographic documentation as part of their review process to determine if the condition qualifies as medically necessary rather than cosmetic. Providing well-lit, professional-grade images that accurately depict the extent of tissue enlargement can help demonstrate the need for surgical correction.

Navigate Insurance Pre-Authorization Like a Pro

Final Thoughts: How to Get Gynecomastia Surgery Covered by Insurance

Most insurance carriers approach male breast reduction surgery for gynecomastia with caution, often labeling the procedure as cosmetic unless medical necessity is firmly established. For individuals seeking insurance coverage for gynecomastia surgery, providing compelling medical evidence and meeting the insurer’s specific criteria are key to obtaining approval.

These criteria typically include documentation of underlying causes, evidence of persistent symptoms (physical discomfort, functional impairment, or psychological distress), and proof that conservative treatments have been attempted without success.

As insurance policies evolve, it is crucial to consult the patient’s specific plan and maintain meticulous documentation. Submitting comprehensive medical records, high-quality photographs, and diagnostic tests can help strengthen the case for medical necessity. By adhering to the outlined guidelines, patients can significantly increase the likelihood of receiving approval for gynecomastia correction when it is medically justified.

Contact Dr. Moein at the Gynecomastia Center in Los Angeles, CA, Santa Monica, pasadena and riverside for expert guidance and high-quality gynecomastia treatment. Our team specializes in helping patients navigate the insurance process and achieve the best possible outcomes. Call us today at (310) 896-4043 to schedule a consultation.